Privacy Cash: Over $121M in Private Transfers During Its First 100 Days

A concise look at early adoption and user behavior on Solana

- Published:

- Edited:

Since its launch in late August 2025, Privacy Cash has positioned itself as a decentralized protocol for private $SOL transfers, using zero-knowledge proofs to break the onchain link between sender and receiver.

$USDC private transfer testing began on devnet in late November, marking a shift toward enabling privacy for stablecoin transactions and expanding the protocol beyond $SOL.

A closer examination of onchain data can help clarify how users are engaging with the protocol and how the introduction of private transfers may shape broader activity within the Solana ecosystem.

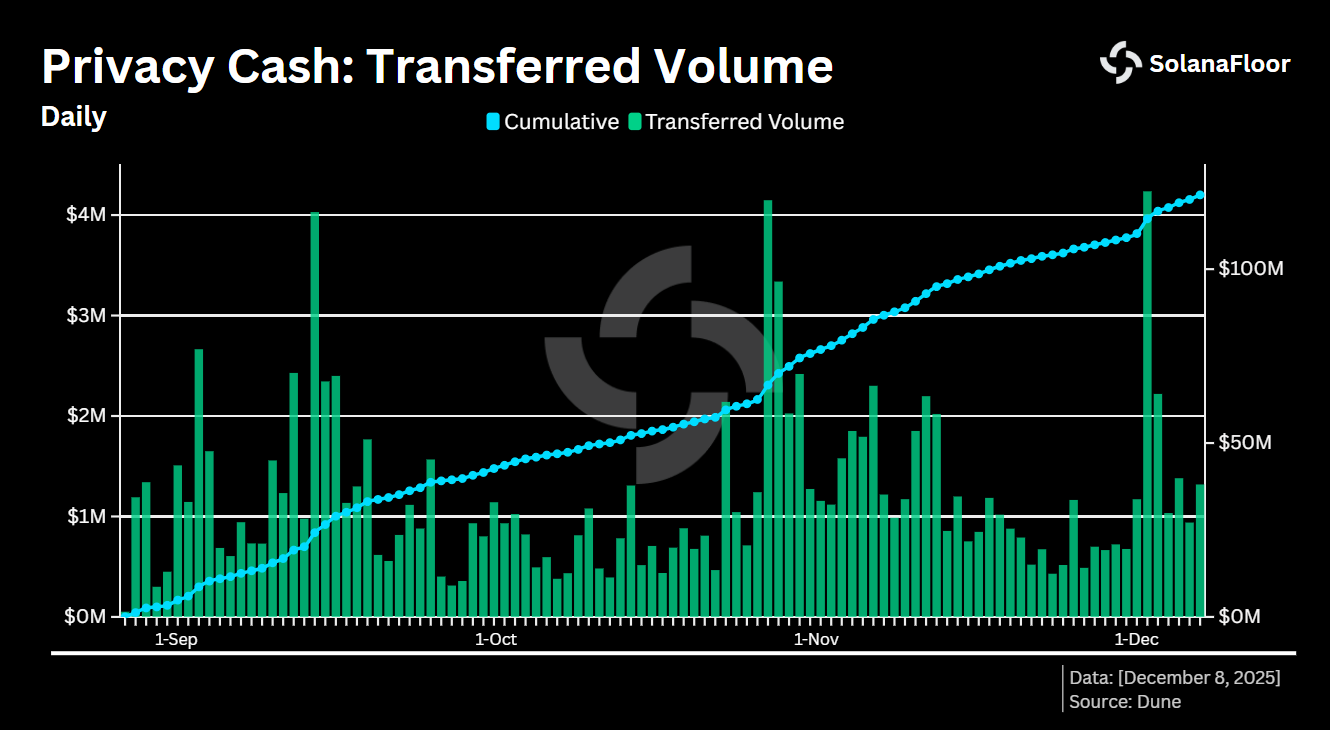

Transfer Volume Shows Strong Early Activity

Across the past 100 days, Privacy Cash has processed more than 680K $SOL in combined deposits and withdrawals, equivalent to roughly $121M. Activity reached a notable peak last week when the protocol recorded its highest single-day volume to date, with 32.5K $SOL transferred, valued at $4.24M.

Across the past 100 days, Privacy Cash has processed more than 680K $SOL in combined deposits and withdrawals, equivalent to roughly $121M. Activity reached a notable peak last week when the protocol recorded its highest single-day volume to date, with 32.5K $SOL transferred, valued at $4.24M.

Weekly volume trends show considerable variability. Transfers ranged from $3.3M in the final week of August to more than $15.4M by late October. In the most recent week, weekly transfer volume stabilized $12.3M. The protocol’s TVL currently stands at just over $620K.

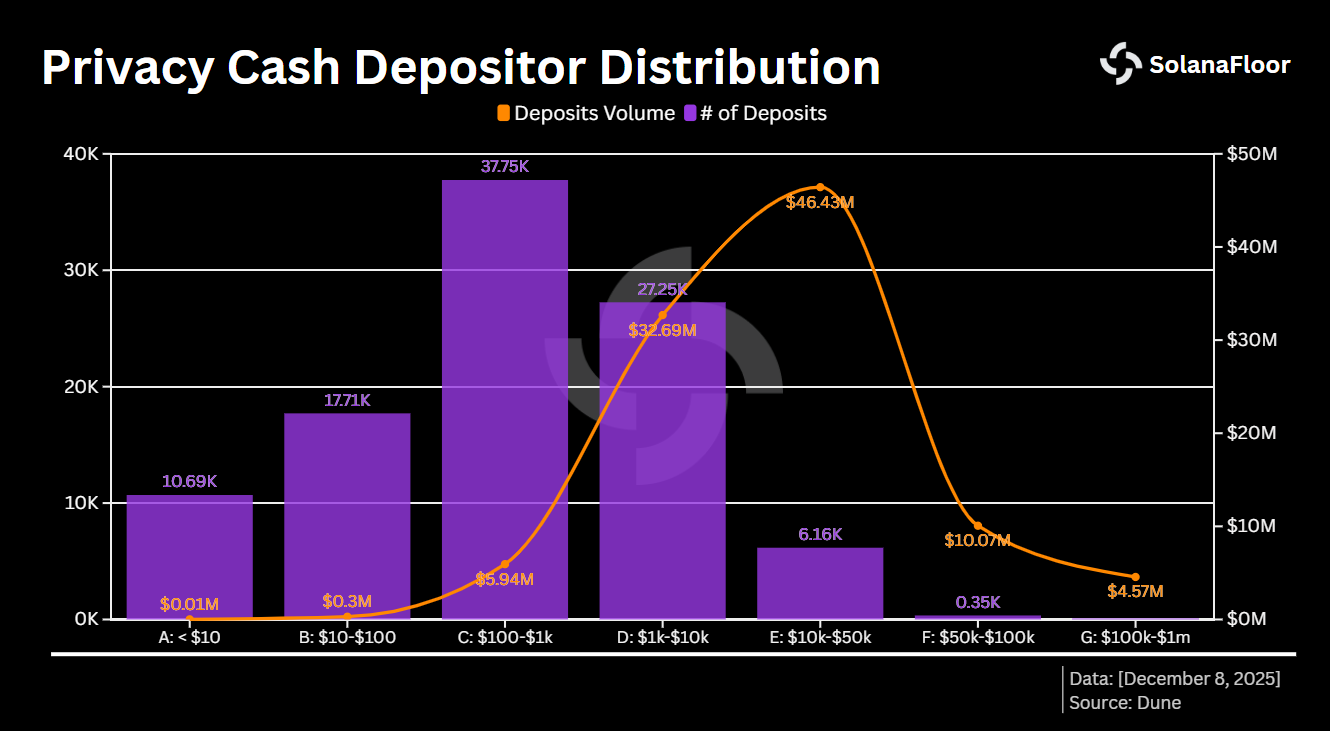

Transaction Size Data Points to a Broad User Base

The most common deposits fall in the $100-$1,000 range, with more than 37.7K deposits-around 37.8% of all transactions-occurring within this band. The second-largest group consists of deposits between $1,000 and $10,000, with more than 27.2K recorded transactions. Although these smaller deposits dominate transaction count, the largest aggregate value transferred came from deposits between $10,000 and $50,000, totaling $46.4M.

The most common deposits fall in the $100-$1,000 range, with more than 37.7K deposits-around 37.8% of all transactions-occurring within this band. The second-largest group consists of deposits between $1,000 and $10,000, with more than 27.2K recorded transactions. Although these smaller deposits dominate transaction count, the largest aggregate value transferred came from deposits between $10,000 and $50,000, totaling $46.4M.

Taken together, these patterns suggest deposits are spread across small and mid-sized users rather than concentrated among a handful of large participants.

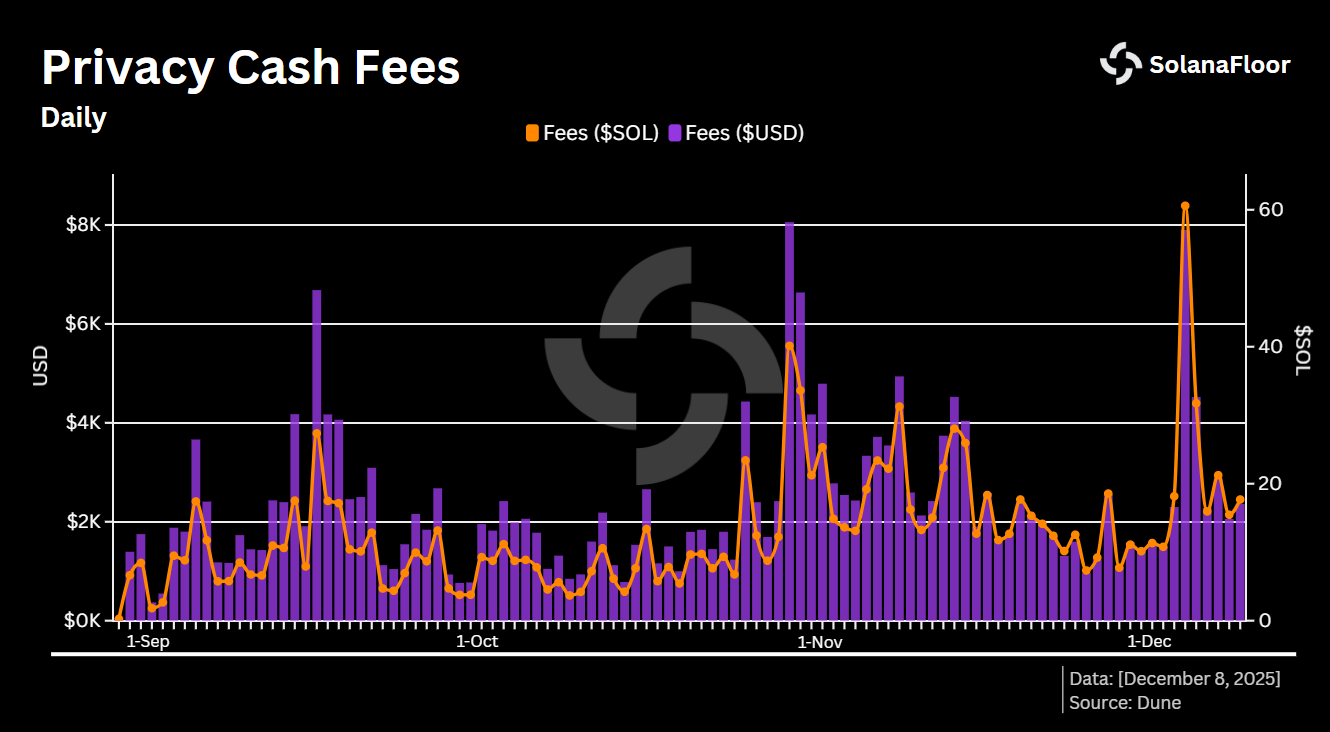

Fee Revenue Reaches $241K

Privacy Cash charges no fee on deposits, while withdrawals incur a 0.35% fee plus 0.006 $SOL. Based on onchain data, cumulative fees collected by the protocol have surpassed 1.35K $SOL, or around $241K. Fee activity also set a new high last week, exceeding 60 $SOL in a single day-marking the largest fee amount recorded since launch.

Privacy Cash charges no fee on deposits, while withdrawals incur a 0.35% fee plus 0.006 $SOL. Based on onchain data, cumulative fees collected by the protocol have surpassed 1.35K $SOL, or around $241K. Fee activity also set a new high last week, exceeding 60 $SOL in a single day-marking the largest fee amount recorded since launch.

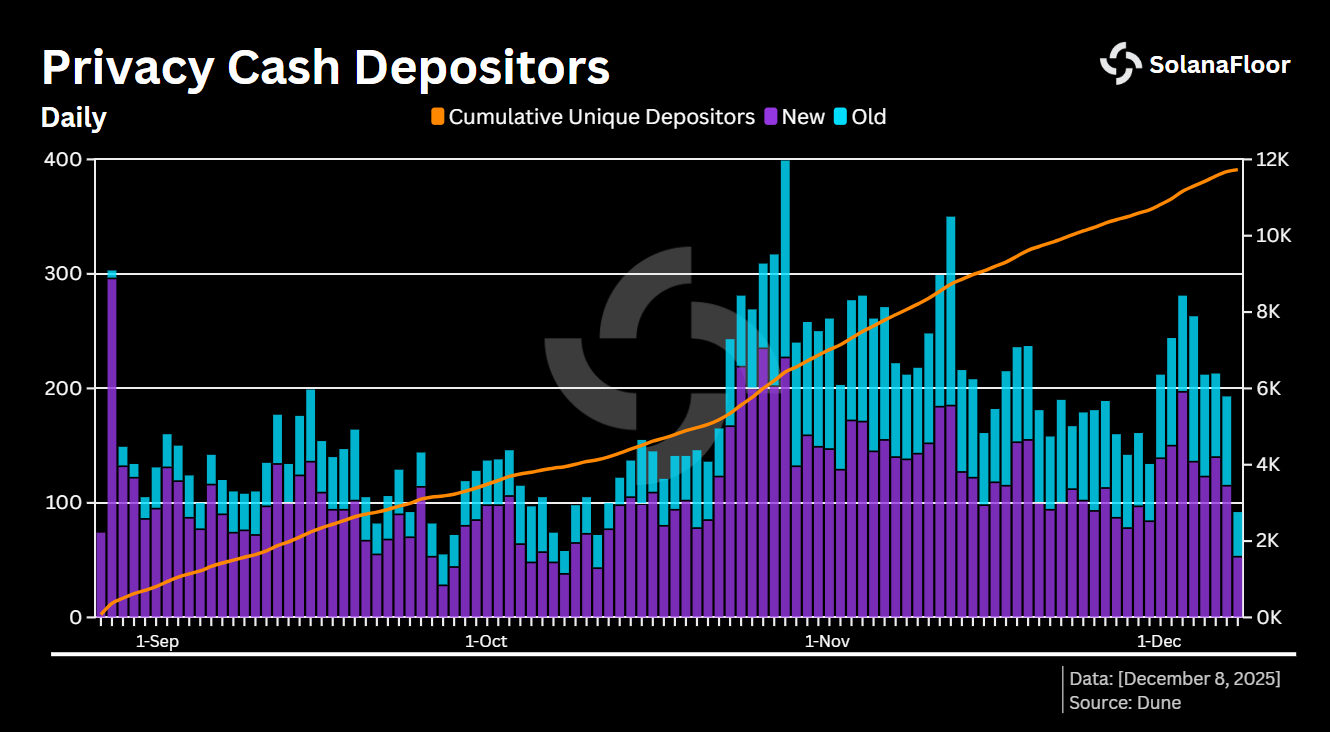

Growing User Participation

More than 11.7K wallets have interacted with Privacy Cash so far, generating over 61.8K transactions. Active wallets have increased significantly since mid-November. Daily active wallets rose from 136 on October 21 to 399, reflecting a noticeable uptick in recurring usage. Over the past week, daily active wallets averaged more than 200, indicating sustained user engagement.

More than 11.7K wallets have interacted with Privacy Cash so far, generating over 61.8K transactions. Active wallets have increased significantly since mid-November. Daily active wallets rose from 136 on October 21 to 399, reflecting a noticeable uptick in recurring usage. Over the past week, daily active wallets averaged more than 200, indicating sustained user engagement.

What the First 100 Days Show

Across deposits, withdrawals, fee revenue, and user activity, onchain data reflects consistent adoption throughout the protocol’s first 100 days. More than 680K $SOL moved through the protocol, over 11.7K wallets deposited, and cumulative fees surpassed $241K. These figures indicate ongoing demand for private transfers, while transaction-size distribution shows participation spanning small to mid-sized users.

By expanding support to additional assets within the Solana ecosystem, including stablecoins with a market cap of approximately $16.7B, the protocol may be positioned to attract a broader user base and facilitate higher volumes.

This piece is part of our Solana Data Insights series. Make sure to subscribe to Solana Data Insights for weekly onchain analysis.

Read More on SolanaFloor

Solana Staking in 2025: Institutional Momentum Grows as Marinade Select Surpasses 3.1M $SOL IN TVL

How Solana Tokenized Stocks Became “Free Money”